Blog | All Posts | All Topics

7 best payroll software

The best payroll software solutions will accurately save you time and money. But with so many options, it can be difficult to know which solution is the best for your business.

Many businesses outsource their payroll services to Visory, so it’s safe to say our experts have worked with a wide range of payroll tools over the years. This guide covers seven of the current best payroll software solutions for businesses.

What is payroll software?

Before we dive into our software list, it’s necessary to highlight what payroll software actually is. Why? Because this is unclear for many, and we have seen Microsoft Word and even an instance of Powerpoint being used as ‘payroll software’.

Payroll software is a digital tool that can automate and manage the process of calculating and distributing employee wages, taxes, and benefits, ensuring compliance with Australian payroll regulations such as STP and streamlining payroll management for businesses.

Using payroll software can make it much easier to manage employees and pay them accurately. However, it can still take significant time and energy to manage, especially for growing businesses. If you’re looking at payroll software options, also consider outsourcing payroll functions to experts. Technology makes it easier, but there are still many complexities and best practice processes that require expertise to manage.

Here are some of the best payroll software options currently available for businesses in Australia.

1. Xero

Xero is an ideal payroll software for small businesses that want payroll and accounting solutions in one. It offers various projections and reports, such as automated calculations, taxes, expenses, and outgoing bills.

Xero integrates with many accounting and HR systems, so it’s easy to give your accountant or payroll manager access. It’s also single-touch payroll (STP) compliant.

| Pros | Cons |

| User-friendly interface | Limited support (Live desk help) |

| Inexpensive for sole traders and small businesses | Lack of flexibility to manage annual leave accrual dates separately from employment start dates |

| Manages both non-GST and GST-registered workers and withholding tax in the same system | Primarily an accounting software with some payroll features |

| Free trial |

Pricing: Monthly plans are between $29-$110 AUD

Visory integration: Yes

Best for: Sole traders and small businesses that manage accounting and payroll in one platform

2. Employment Hero

Employment Hero is a versatile payroll software combining payroll, HR, and employee benefits management into a single platform. It offers comprehensive features, including:

- Automatic pay runs

- Payroll reporting

- Timesheet tracking

- Leave management

- Employee onboarding

- Compliance management

The intuitive user interface makes it easy to navigate. Employment Hero also acquire KeyPay, so it’s easier to effectively manage your workforce and payroll all in one centralised solution. They’ve also recently introduced AI features that can help automate processes and save time.

| Pros | Cons |

| Free 14-day trial | It focuses on HR and payroll, so you’ll need a separate bookkeeping and accounting software |

| User-friendly | |

| The mobile app assists the employee in requesting time off and tracking pay stubs |

Pricing: Plans range between $5- $7 AUD per employee per month

Visory integration: Yes

Best for: Growing businesses that want complete payroll and HR solutions

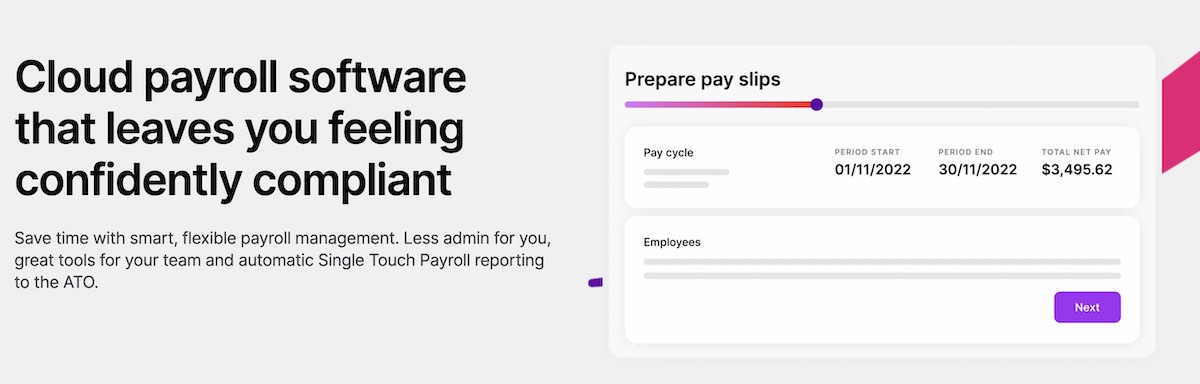

3. MYOB

MYOB is a comprehensive payroll solution for businesses of all sizes. Notable payroll features include:

- Automated pay runs

- Tax and superannuation calculations

- Real-time expense reports and budgets

- Timesheet management

- STP reporting

With MYOB’s customisability, you can personalise the software to suit your specific payroll requirements, making it a reliable and efficient choice for managing payroll effectively.

| Pros | Cons |

| Useful for basic accounting | The interfaces isn’t as user-friendly as others |

| Easy and quick to extract data | |

| Free trial |

Pricing: Monthly plans are between $30 – $170 AUD

Visory integration: Yes

Best for: Growing businesses with many employees

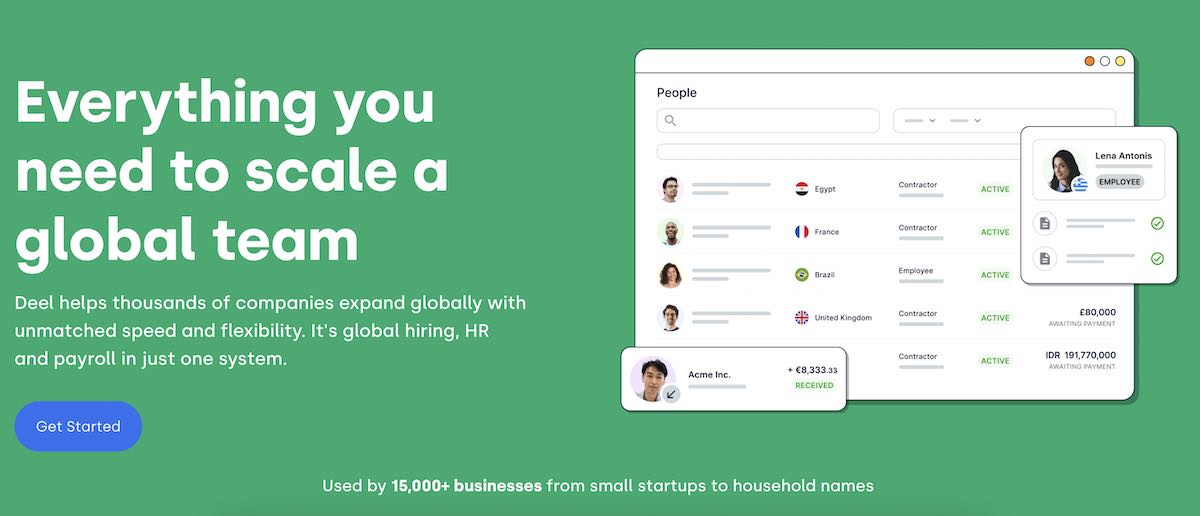

4. Deel

Deel is an ideal payroll software for businesses with global, remote teams and contractors.

Its features include:

- Automated onboarding

- Time tracking

- HR management

- Contractor management

- Compliance reporting

- Deduction management

What sets Deel apart is its capability to handle payments for contractors in different countries and currencies.

| Pros | Cons |

| Quick and easy setup | Limited invoice customisation |

| Add-ons available for global payroll | Complicated contract templates |

| Mobile app for employees to quickly access their pay stubs, time off requests, and other information | Pricing is per contractor, so the cost increases with workforce size |

| Only enterprise subscribers are eligible for CSMs | |

| Lack employee support |

Pricing: Monthly plans range from $0 – $599 AUD

Best for: Businesses that work with many contractors and global, remote workers.

5. Gusto

If you’re a small business owner, Gusto is an all-in-one HR, payroll, and benefits software you’ll love. It simplifies employee onboarding, time tracking, and automatic tax filing.

What’s impressive about Gusto’s payroll software is its flexibility. It can handle payroll for full-time, part-time, and contract workers.

| Pros | Cons |

| Easy to use for employers and employees | It doesn’t offer any accounting features |

| Unlimited payroll runs | It doesn’t have billing features |

| Integrates seamlessly with other software, such as accounting and time-tracking solutions | Dedicated support is only available for premium |

| Basic reports are available in all tiers | Ideal for small businesses and startups but not large organisations |

Pricing: Monthly plans start $40+ $6 AUD per person

Visory integration: Yes

6. Quickbooks Payroll

Quickbooks is a popular, cloud-based accounting software for small and medium businesses.

You can send customisable invoices and manage inventory, accounts payable (AP), and accounts receivable (AR).

Quickbooks is primarily an accounting software. Its payroll solution is actually powered by Employment Hero.

| Pros | Cons |

| 30 days free trial | Expensive subscription |

| 50% off discounts for the first three months | Limited support for lower tiers |

| STP compliant | More of an accounting software than payroll |

| Easy set up |

Pricing: Monthly plans range between $25 – $55 AUD

Visory integration: Yes

Best for: Sole traders and small businesses with limited payroll needs

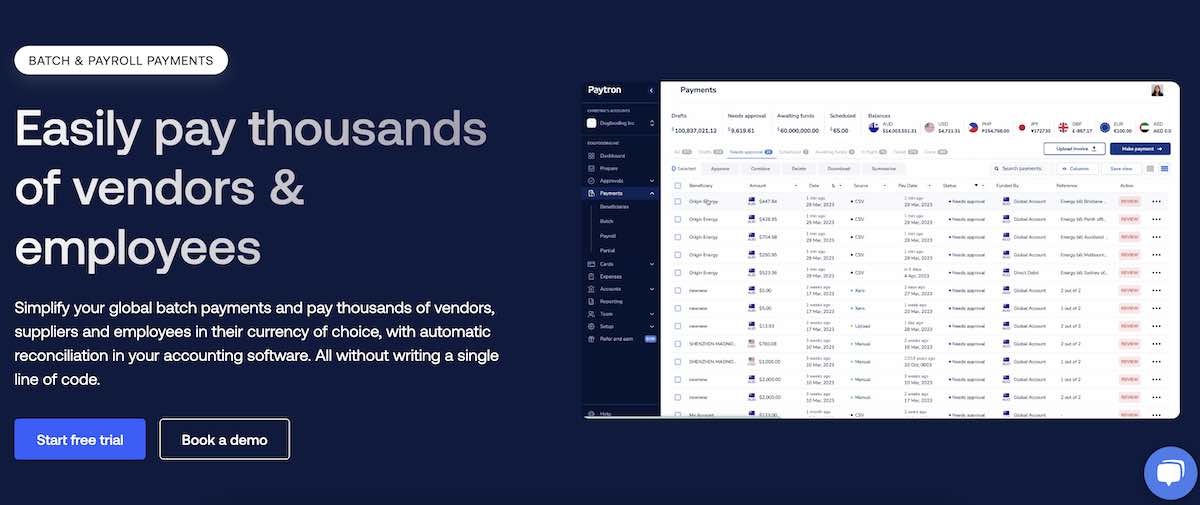

7. Paytron

Paytron is a payroll and bill payment software available in 180 countries and can make payments globally within the same day. It can help you seamlessly manage accounts payable and accounts receivable with workflow automation and approval tools.

Other features of Paytron payroll are:

- Automated invoice management

- Batch payments for vendors and employees

- Virtual card management for expenses

Paytron integrates with Employment Hero. You can make payroll payments within a secure encrypted connection with just one click. Small, mid, and large businesses use Paytron, but it’s not a complete payroll solution.

| Pros | Cons |

| 24/7 live support | Not a complete payroll software. It helps you make payroll payments. |

| One-click payroll processing | The lowest package has minimal features |

| Integration with Xero, KeyPay, and Employment Hero | |

Pricing: Monthly plans start at $125 AUD

Best for: Managing payments in combination with another payroll software

Best payroll software for your business

Choosing the right payroll software for your business can make paying and managing your workforce easier. It can save time for HR teams and prevent payroll errors.

Evaluating factors such as cost, features, user interface, and integration capabilities can help you decide which is the best option for your business.

If you’re looking for a reliable payroll solution, consider outsourcing your payroll processing to Visory. Certified and vetted bookkeepers and payroll experts provide fast and accurate payroll processing services to businesses in Australia and New Zealand. Whether you’re a small business or a large enterprise, our cloud-based system can help you manage your payroll with ease. Contact Visory today to get started.