Running a startup? Then you know as well as we do that there’s about 100 different things to get done each day. You’re trying to attract new clients, secure funding, and streamline your service delivery — all with a skeleton crew.

So who could blame you for letting your books fall to the wayside? As it turns out, your future self.

Visory has worked with hundreds of small business owners and as a result, have identified the eight most common bookkeeping mistakes made each year

In this post, we’ll share the most common tax mistakes we see business owners make every year – and more importantly, how to avoid these costly errors for your small business.

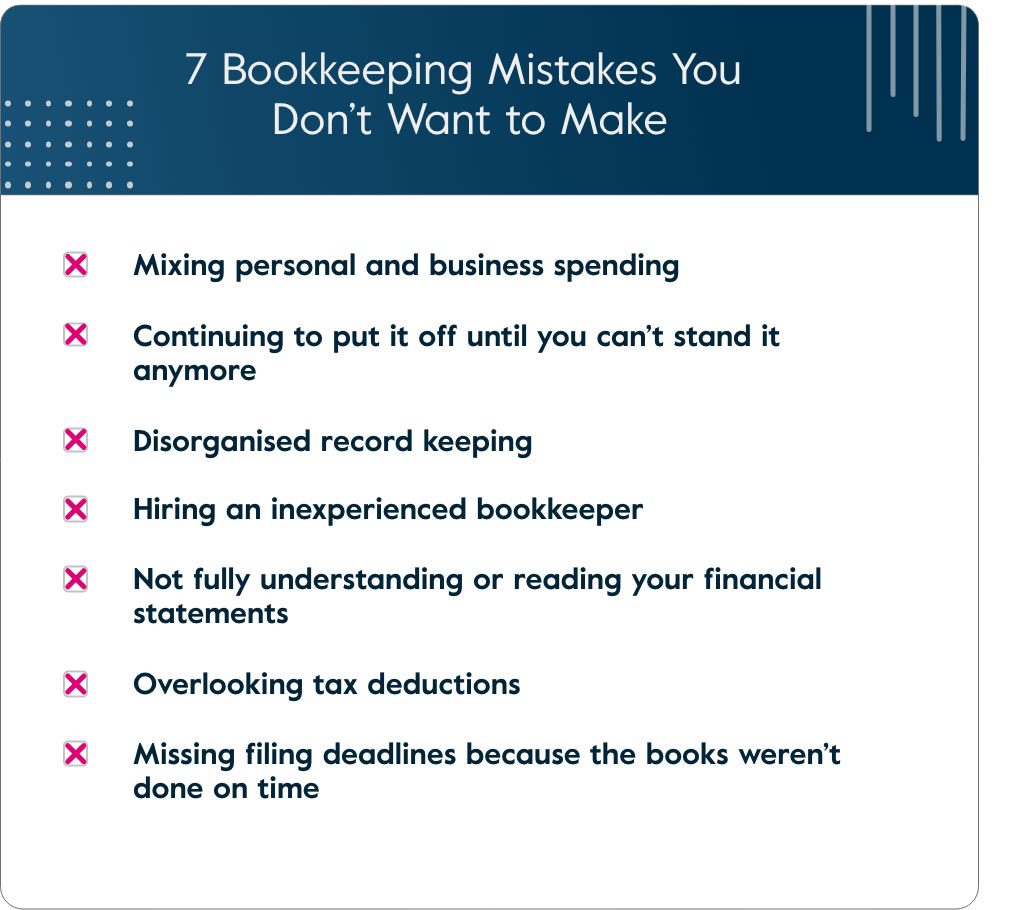

7 Bookkeeping Mistakes You Don’t Want to Make

As a go-to bookkeeping team for startups and scaleups, we’ve seen the same bookkeeping mistakes made over and over again. Whether you’re scaling a SaaS business or running tech company, there are some foundational best practices that protect your company in the long run.

While avoiding these common financial mistakes might seem small, from our experience, they have a tendency to snowball. Let’s dig in.

1. Mixing personal and business spending

As a solo founder, you may end up spending your own money to get the organisation up and running. This is extremely common for growing business. There is nothing wrong with this initially but things get messy fast if you commingle your personal and business funds in the long run.

Everything from swiping your personal credit card to pay for a software subscription to paying office rent could bite you later and here’s why – commingling personal and business money makes for a confusing tax situation and business owner can get flagged by the government if their returns aren’t accurate. Essentially, mixing your personal and business accounts makes things messy and even if you have a CPA you trust, you’ll still spend hours seperating out your expenses.

According to the Australian government, you must have a separate business bank account if you run a partnership, company, or trust. If you are operating your startup as a sole trader, you aren’t required to have a separate business account; but the government still recommends you open one.

Having a separate business bank account has a number of benefits, including:

- Making it easier to track and categorise your business expenses.

- Allowing you to create internal reports, like balance sheets and profit and loss statements without pulling in personal expenses by accident.

- Ensuring you will have all the information you need to lodge your business taxes. You need documented proof of your expenses and income come tax time.

- Protecting yourself legally if your business ever faces litigation; if your personal funds are used for business purposes, you may be held personally responsible for business liabilities.

In order to sufficiently separate your personal and business money, we recommend that you take these four steps:

- Open a separate business bank account with a business debit card and cheque book.

- Have a business credit card that you pay off with business funds.

- Come up with a way to ensure you don’t confuse business and personal cards. Get a card from a new bank or in a totally different color scheme so you never grab the wrong card by mistake.

Visory Tip: As a startup, you also want to be careful about who has access to your business account. The more people who can spend from this account, the more mistakes that can be made. Give each account holder an individual card so you know who is spending what.

2. Continuing to put it off until you can’t stand it anymore

Like going to the dentist, many startups put off their bookkeeping until it hurts. It’s tempting, but it’s not worth it. Your startup needs accounting processes in place as soon as possible.

If you put off bookkeeping until you can’t avoid it anymore, several things are likely to happen.

- You will end up paying someone to do catch up bookkeeping. This type of bookkeeping requires someone to go back through old records, try to dig up ancient receipts, and piece together your finances with missing data. It’s better to maintain bookkeeping records as you go than try to catch up months later.

- You will have missing receipts and invoices. Over time, documents get lost. Emails get deleted. You forget things. Putting off bookkeeping is bound to make the inevitable reckoning more stressful.

- You will hate the bank reconciliation process. Reconciling your bank account with your internal records should be done monthly. Imagine having to do 12+ months at once. No thank you.

- You may not have all necessary tax documents. In order to deduct business expenses on your taxes, you need proof of your spending. If you put off bookkeeping for too long, you may miss out on deductions because you didn’t document your spending accurately.

- Visory Tip: When you own a business, and especially if it’s a startup, you may overlook tax deductions that could save you money and time. Without an organised process, we see many startups leave money on the table during tax time because they don’t have their books in order.

- You could find a mistake long after it happened. One mistake can lead to another, which leads to another, which… well, you understand. A simple accounting error could become a major headache. You want to catch errors fast.

3. Disorganised record keeping

Startups often have an organisation problem. It’s understandable, given how depleted your energy and limited resources are. Many startups have just a handful of employees, and receipts get put into a folder until someone takes the time to sort them.

However, you will likely live to regret this way of operating. Disorganised record keeping could lead to lost documents, unpaid bills, uncashed cheques, and missing reports. If your supplier cuts you off because you don’t have an accounts payable process and you never settled your last invoice — you will wish you had streamlined sooner.

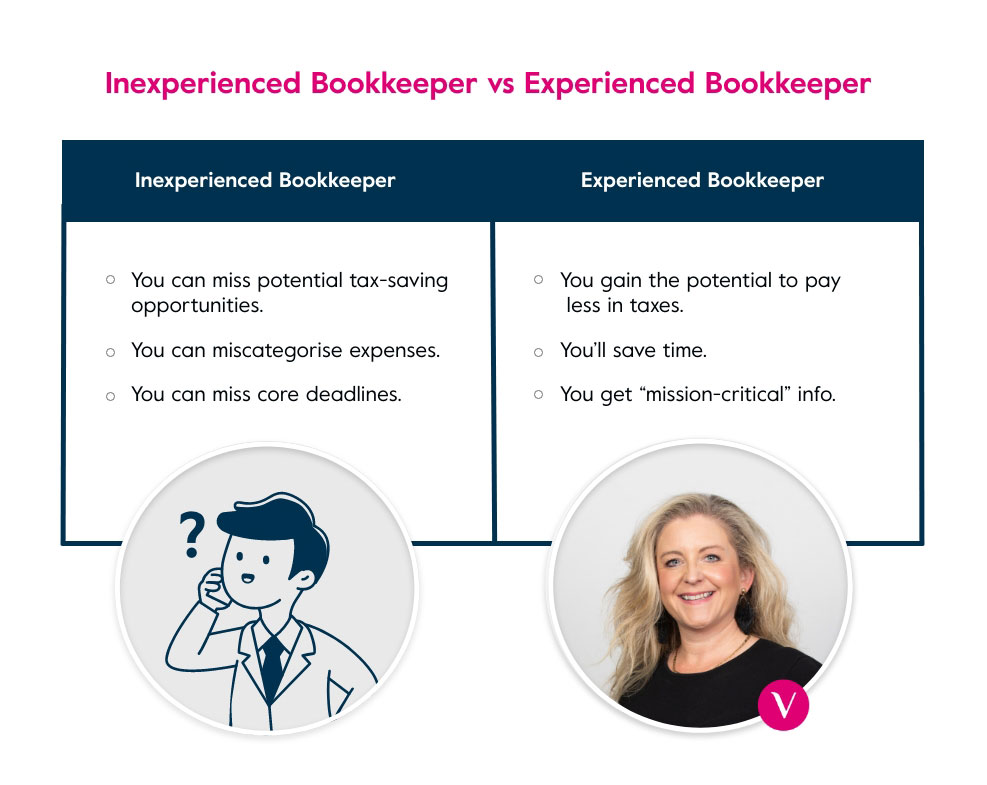

4. Hiring an inexperienced bookkeeper

Hiring an inexperienced bookkeeper may not be as bad as having no bookkeeper… but it certainly creates its own issues. A certified bookkeeper, one with real experience working with early stage companies, has several distinct advantages for a startup (instead of asking your cousin who is kind of good at math).

An experienced bookkeeper, who has worked with startups in your industry, will be better at:

- Creating your Business Activity Statements (BAS), which are required when you lodge your business taxes.

- Maintaining your Pay as You Go (PAYG) instalments for quarterly taxes; some startups may not make enough to be required to have a PAYG schedule, but eventually you will need to stay on top of these instalments.

- Setting up your accounting software and structures. An inexperienced bookkeeper may not be up to date on the most modern software tools or know how to create a secure financial infrastructure for your financial documents and accounts.

- Applying for an ABN. Your company will want to get an Australian Business Number (ABN) and an experienced accountant can help you get it.

- Dealing with the ATO. If you have tax questions or need to get a tax form, an experienced bookkeeper can step in and deal with the Australian Taxation Office to get things sorted. An inexperienced bookkeeper may not know where to start.

Want a free financial health check?

A Visory Success Manager will analyse your business’ financials and identify areas where your back-office processes could be improved. If nothing else, it’s an opportunity to think through ideas for your business, and we can leave it at that.

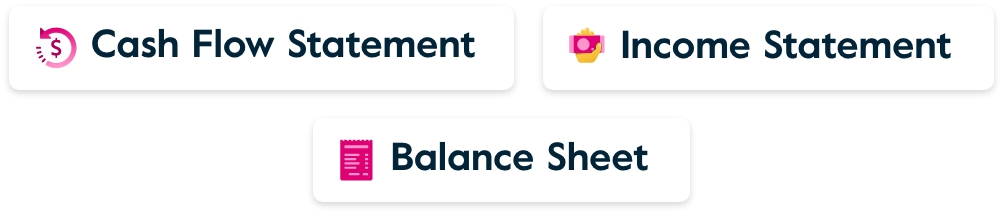

5. Not fully understanding or reading your financial statements

Financial data without analysis is just numbers of a page . If you don’t understand how to interpret your financial reports, you could make bad decisions. Worse, you may not know what essential reports you need to create for your business. Having the right documents on hand allows you to draw thoughtful insights and make informed decisions.

Some startups have the right reports being created — but they ignore them. This could mean you miss a financial error or don’t realise you’re falling into debt. It’s not just important that you generate reports, it’s also important to analyse them for insights.

Here are some of the things you should understand about your financial statements. If you’re not sure how to read them, it’s time to call in reinforcements.

- Reading a balance sheet. Your balance sheet tracks your assets, liabilities, and current shareholder equity (including owner equity). Your assets are equal to your liabilities plus your equity. The two sides of the report should even out.

- Reconciling bank statements. Your bank balance and reported transactions should match what your internal reports say you’ve been spending. You or your bookkeeper should check monthly to see if there are discrepancies such as missing money you can’t account for.

- Looking over profit and loss statements. Also called an income statement, this important document can tell you how much you spent and how much you earned in a particular time period. You should be able to analyse it and understand if you are overspending or if you have redundant expenditures.

- Reading your accounts receivable and accounts payable reports. Accounts receivable tracks income that is due to you from clients or lenders, and accounts payable tracks your immediate debts. You should be able to understand how to track these reports and what the process is to make sure you get paid on time and pay your bills on time.

6. Overlooking tax deductions

Tax deductions are expenses you paid for your business that can offset your tax burden. In other words, by claiming business expenses on your taxes, you may lower your tax bill. Overlooking deductions is often an expensive mistake.

Tax deductions can get complicated. From claiming the wrong items to missing a deduction or timeline, you could wind up paying more taxes than you need to. At Visory, there are three important rules we keep in mind when searching for tax deductions.

According to the Australian government, in order for an expense to qualify as a tax deduction, it must meet all three of these provisions:

- The expense you are claiming must have been for business use, not private use. Don’t try to slide in a personal mobile phone as a business expense. You can only deduct it if you use it to run your business operation.

- When an expense is related to both business and private use, you can only claim the business portion. If you use a vehicle for work 50% of the time and personal leisure 50% of the time, you can’t claim the entire car on your business taxes. In this case, you would claim half the value of the car on your business taxes.

- You must have adequate records to prove where your expenses went. It’s not enough to tell the government your startup spent $5,000 on new laptops. You must have the receipts. Failing to supply proper documentation with your deductions will likely result in your deduction being denied. Document, document, document.

At the end of the day, you may be able to deduct more expenses than you think. For instance, companies can deduct any supplies they use to sanitise their offices against COVID-19. This includes the hand sanitiser you put in the bathrooms and any personal protective gear your staff wear when interacting with the public.

7. Missing filing deadlines because the books weren’t done on time

The ATO requires you to lodge your business tax returns by a certain date (for 2022, the due date for taxes is October 31st). If you don’t file on time, you could be subject to something called Failure to Lodge (FTL) penalties.

Individuals and businesses that fail to pay on time, because their books aren’t in order or they miss the deadline, may not be fined for a single offense. However, the government reserves the right to apply these penalties and we’ve certainly seen that happen. Startups with GST turnover of under $1 million are considered a “small entity” and the FTL penalty is applied at one penalty unit for every 28 days that that return is late (up to a maximum of five units).

In addition to filing annual tax returns, keep in mind that you may be responsible for quarterly taxes and most investors may also want periodic reports about your financial health. The more organised you are with your monthly bookkeeping, the easier it is to pull these reports and file on time.

The Main Takeaways

Between conversations with investors, validating your idea, acquiring new customers, building your team and reviewing term sheets, running a startup is a tricky balancing act. In our experience, it’s easy to see why some companies may not collect the financial data they should, and they often ignore data when they should analyse it. There is a lot to get done and only so much time in the day. A lot of problems boil down to overwhelmed small businesses not having the time or expertise to take care of their books properly.

If you are a startup who is struggling with keeping accurate books, we recommend getting help from our team. When you work with Visory, we pair your organisation with an industry insider who can not only crunch numbers, but also offer meaningful insights. Even before you’re ready for a CFO, you can gain CFO-level knowledge if you have a bookkeeper who has been working in your field for many years. Want to learn more? Let’s chat.

Check out our other playbooks

Table of Contents

7 Bookkeeping Mistakes You Don’t Want to Make

1. Mixing personal and business spending

2. Continuing to put it off until you can’t stand it anymore

3. Disorganised record keeping

4. Hiring an inexperienced bookkeeper

5. Not fully understanding or reading your financial statements

7. Missing filing deadlines because the books weren’t done on time