When an investor approaches you with interest in your company, can you give them detailed insights about the business’ financial health? Or do you say “Oh, we’re growing fast” without any specifics? Be honest. If you don’t have a CFO or you haven’t been analysing your financial data — you don’t really know how your organisation is faring financially.

By establishing key performance indicators (KPIs), you can quantitatively measure your debt-to-income ratio, customer retention, and other important statistics. This allows you to create realistic projections. With a keen understanding of financial health, you will also spot red flags a lot faster and may be able to change course in time to avoid disaster.

Visory has worked with law firms, architecture firms, medical offices, marketing agencies, and other professional services. This blog summarises real data, as well as benchmarks that Visory has acquired from working successfully with professional services firms.

Let’s talk about why your company needs KPIs and how to measure them.

Why Businesses Need KPIs

Business founders have lofty goals for their companies. But how do you get there? Setting critical success factors and key performance indicators gives you a roadmap.

Critical success factors (CSF) are the activities that are necessary for you to achieve growth and success. These may include generating strong cash flow and increasing profitability. The KPIs of your organisation are the tools you use to measure your progress. If your CSF is customer retention, your KPI may be “Have [X number] repeat purchases over the next quarter.”

KPIs should be clear and reasonable. But that’s not all. A good KPI is SMARTT: Specific, Measurable, Achievable, Relevant, Targeted, and Timeframed.

Your business needs KPIs in order to gain insights into the financial trends in your company. They may help you identify areas of struggle where you thought you were doing well. You may realise you can’t scale up as quickly as you thought you could and need to reevaluate your projection goals.

Many businesses measure their success against an industry standard, also called a benchmark. Benchmarking can also refer to comparing your KPI measurements against a competitor.

Healthy KPI benchmark standards vary depending on industry. Benchmarks related to customer satisfaction and profitability growth may remain consistent across industries, but realistic goals will depend on the market trends in your field.

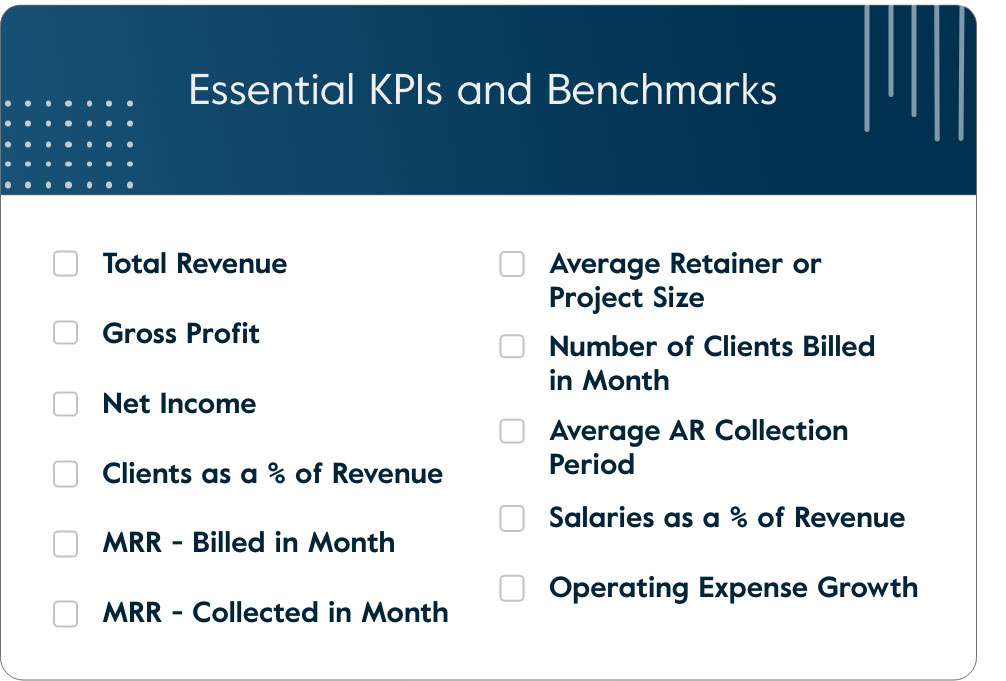

Essential KPIs and Benchmarks

Visory has worked with many professional services businesses. Along with helping our clients organise their books and manage their payroll, we have learned a lot about the best KPIs and industry benchmarks.

Here are the most essential key performance indicators, explained.

Total Revenue

The simple formula for measuring revenue is: total number of units sold multiplied by the average price. If you sell 100 units at $2, your revenue is $200. Expenses are then subtracted to determine your company’s net profit for the period being analysed.

As a KPI, revenue can be measured as:

- Revenue growth M-o-M % – The growth of your revenue, month over month, as a percentage increase or decrease. A realistic goal for increasing revenue per month may depend on your industry.

Leveraging the Ibis World Professional Services Report, we can easily pull benchmark data for annualised revenue growth.

- 2020-21 – 0.72%

- 2021-22 – 1.05%

Gross Profit

Your company’s gross profit, also called gross income, is equal to the revenue minus the cost of goods sold (COGS). You may also measure your gross profit margin. This formula is: revenue – COGS / revenue. Profit margin calculations yield a percentage figure, which shows you what percentage of the revenue actually reflects true profit.

A gross profit KPI can be measured as:

- Gross profit M-o-M% – The increase or decrease of your gross profit month over month can reveal if the sales of a particular product or service is trending in the right direction. Aim to increase your gross profit by a modest margin every month to scale realistically.

While it can be more difficult to find gross profit averages for professional service, you can still lean on Gross Operating Profit. Leveraging the Ibis World Professional Services Report, at Visory, we look at two things:

- Company gross operating profits, current prices:

- Rose 17.2% seasonally adjusted

- Wages and salaries, current prices:

- Rose 3.0% seasonally adjusted

Net Income

Where the gross profit measures the profit that remains after your company’s liabilities, your net income offers a big picture bottom line. Your net income takes your sales figures and subtracts your COGS, taxes, operating expenses, depreciation losses, and other business costs.

Where your gross profit can reveal if you are maximising your potential profits, net income reveals if your business’ finances are generally well managed. How profitable are you overall?

Your net income KIP can be quantified as:

- Net Income Growth M-o-M % – if your net income begins to decline, it may indicate inefficient spending or a dramatic drop in sales. Steady increases suggest promising future profitability. As with revenue, the KPI goal for increasing net income is usually done by creating small incremental goals over time.

Want a free financial health check?

A Visory Success Manager will analyse your business’ financials and identify areas where your back-office processes could be improved. If nothing else, it’s an opportunity to think through ideas for your business, and we can leave it at that.

Clients as a % of Revenue

It makes sense for professional services to diversify their client base. If one client makes up the majority of your income, could you survive without them? Understanding your clients as a percentage of your total revenue helps you identify when you need to add new substantial streams of income.

The general school of thought is that no one client should constitute more than 10-15% of your total revenue. If a client occupies more of your revenue than that, you may be financially unstable if the relationship evaporates.

Your clients as a percentage of your revenue can be calculated as:

- Client revenue / Total revenue — A higher figure indicates a higher customer concentration, which can be a red flag. Depending on your industry and your current client revenue, you may want to create a KPI that decreases customer concentration by a few percentage points each quarter.

While this mix looks different for every single fast-growing company we work with at Visory, it ultimately comes down to efficiency. When you track clients as a % of revenue, you have more visibility into the companies contributing to your revenue. You can also trim clients that take up time but aren’t contributing to your overall revenue in any significant way.

Here’s a great example: At Visory, we have a professional services business that in one month, after looking at clients as a % of revenue, eliminated enough work to take on three more accounts it wouldn’t have been able to otherwise. Once the company calculated how much money three more accounts would bring in, it wasn’t just a wash — the team would see real profit.

MMR Billed in Month

Whether our project-based or retainer-based as a professional service business, most Visory clients benefit from tracking monthly recurring revenue (MMR). A dip in MMR income can indicate large-scale issues and predictability. Are your clients dropping off because your service has changed and they don’t like it? Are you intentionally trimming your client list to make space for new accounts? Is a competitor luring away your core clientele?

MRR analysis is helpful in determining if you are experiencing client retention or attrition.

As a KPI, you can quantify the MMR you bill fairly easily:

- Monthly MMR as a $ — The MMR formula is the number of monthly users multiplied by the average revenue per user (ARPU). If you have 100 users paying $100 per month for service, you bill $10,000 in MMR. KPIs for MMR shoot to increase MMR billables over time.

Tomasz Tunguz (Venture Capitalist, Redpoint) says that an MRR growth rate of 15-20% is a reasonably good target for post-Seed/pre-Series A SaaS startups to aim for.

According to Jason Lemkin (Founder, SaaStr), SaaS companies should have the potential to go from $1m- $100m in ARR in 7-10 years. He goes on to say >=20% growth MoM is an outlier, but possible. Most SaaS companies fall under 10-15%.

MMR Collected in Month

It’s important to evaluate your MMR as billables, because this tells you how many people are still signed up for your service. The MMR billed figure applies to your accounts receivable. It’s also good to look at the MMR collected figures. This reveals how much money you actually received from clients.

Invariably, some clients will fail to pay because of insufficient funds, forgetfulness, or other causes. If you calculate what you actually collect — as opposed to what you billed as due — you have a more accurate picture of the month’s cash flow.

You can quantify your MMR collected by measuring:

- The number of billables collected multiplied by the ARPU. When compared to the MMR billed, you can see how many clients have not paid. KPIs for MMR collected are often set as goals to increase the percent of billables paid on time each month.

Average Retainer or Project Size

Increasing your retainer amounts improves your cash flow. It’s in most professional services businesses best interests to measure and grow their retainer income. Likewise, increasing project sizes can warrant higher billables.

As a KPI, it often makes sense to measure retainer funds often:

- Retainer or project growth M-o-M % – Measuring retainer income and project size income month by month lets you identify trends. You can set goals incrementally, such as growing project size by 2% each month.

When it comes to the professional service business that work with Visory, some operate on a retailer model, some do a project fee, and some do both.

Retainer: retainer is a recurring monthly or quarterly agreement between a client and a marketing agency for specified services or consultation.

Project: one-off and you work regularly for a defined period with the client

If you are operating with a retainer pricing strategy, you want to track the retainer size and growth over time, especially to combat inflation. When you get to increase your retainer size, your overall revenue will increase. You have to take on fewer new clients and instead can continue to grow revenue efficiently with higher retainer rates for consistent services.

Number of Clients Billed in Month

This KPI is related to your clients as % of revenue goals. As you steadily increase the number of billed clients each month, you diversify your cash flow sources. You also increase your chances of successful referrals.

Client growth is often measured as a percentage increase between two time periods:

- Client growth M-o-M % – KPIs are set as an increase percentage month over month. You may also have a year end goal for the total number of clients on your roster.

For professional service businesses, this one is super simple. How many clients are you working with? How has this number changed as you’ve increased your retainer or project fees? Do you need more clients to hit your revenue goals or can you upsell existing clients?

Average AR Collection Period

Professional services agencies set a due date for their invoices. Often invoices are due on a net 30 or net 60 basis, meaning that the total balance must be paid within 30 or 60 days. The shorter your collection period, the more efficiently your accounts receivable department can run.

Your average accounts receivable collection period is often referred to as the average days sales outstanding, or the DSO.

KPIs for days to collection are measured in time:

- Number of days to collection – For agencies with a net 30 policy, the average number of days to collection should be no more than 30. Ideally, you would have a collection period of under 30 days — indicating that you are effective in your bill collecting efforts and being paid early. A reasonable KPI for AR collection periods is to aim for all bills to be paid on time.

Tracking this metric as a professional services business is primarily a measure of liquidity – it helps the Visory clients measures how quickly a business can turn sales into cash.

Ultimately, the average collection period depends on the terms in your contract with each client and the time allowed to collect a payment, as well as any fees associated with clients paying late.

Salaries as a % of Revenue

Salaries can eat up a significant percentage of revenue, limiting net profit. Many companies aim for between 15-30% maximum. The lower the percentage, the more efficient your bruins is. Calculating your organisation’s salaries as a percentage of revenue is easy. Payroll percentage = (total payroll expenses / gross revenue) x 100.

Your KPIs for salary to revenue are measured in a percentage:

- Salary to revenue % Y-o-Y – Salaries are measured in longer terms than most other figures. If you are spending 50% of your revenue on salaries, set a goal for ration reduction by next year at this time.

Leveraging the Ibis World Professional Services Report, we can easily pull benchmark data for salaries as % of revenue:

- 2020–21 27.8%

- 2021–22 27.9%

While most professional service business that work with Visory track this metric, the range varies drastically depending on the company’s ultimate goal. For a company that relies heavily on talent and senior team members, their salary expense will be hiring. For a company that outsources work or can scale without hiring, the salary expense will be lower.

Similarly, according to Chron, service-based businesses where payroll is the primary cost involved in producing the product can have labor costs as high as 50 percent without destroying profitability. Generally, payroll expenses that fall between 15 to 30 percent of gross revenue is the safe zone for most types of businesses.

Operating Expense Growth

Operating expenses range from payroll and office supplies to the rent you pay for your agency office and the utility bill to keep the lights on. As you expand your company, operating expenses naturally grow. Figuring out how quickly to increase your spending is key.

Creating a realistic budget for your organisation hinges on making sure you don’t spend too much too fast.

Operation growth KPIs can be measured by monthly increase goals:

- Operating expense growth M-o-M % – Tracking your expenses month over month is the best way to determine spending trends and measure goals. Set a maximum monthly percentage growth for your operating costs.

KPI Summary

Key performance indicators give your company a tangible way to see if you are thriving or flailing. The more you can arm your CFO and accounting team with real data, the better their analysis will be.

So, are you feeling confident with your KPIs and financial reporting? If so, drop us a line, we’d love to see how you measure these metrics and what reporting is most important to you! If you’re feeling a bit intimidated and not quite sure where to start, let’s chat!